The Ultimate Overview to Making Use Of a Secured Credit Card Singapore for Better Financial Monitoring

The Ultimate Overview to Making Use Of a Secured Credit Card Singapore for Better Financial Monitoring

Blog Article

Exploring Options: Can Former Bankrupts Secure Credit Rating Cards Complying With Discharge?

One common concern that occurs is whether former bankrupts can effectively acquire credit cards after their discharge. The answer to this inquiry includes a complex expedition of different aspects, from credit score card alternatives customized to this market to the impact of past financial choices on future credit reliability.

Recognizing Bank Card Options

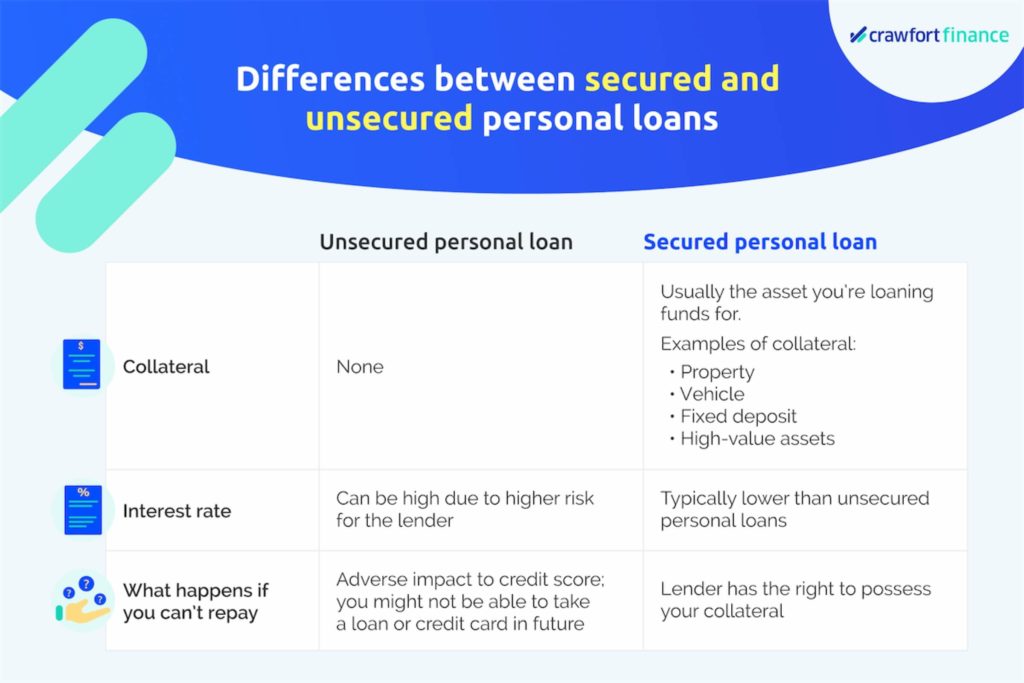

Browsing the world of charge card alternatives needs a keen understanding of the differing terms and functions available to consumers. When thinking about debt cards post-bankruptcy, people need to very carefully evaluate their needs and economic circumstance to select the most suitable alternative - secured credit card singapore. Protected bank card, for instance, call for a money down payment as security, making them a feasible selection for those looking to rebuild their credit report. On the various other hand, unprotected credit history cards do not necessitate a down payment but may feature higher rate of interest and charges.

Furthermore, individuals ought to pay close focus to the yearly portion rate (APR), poise duration, annual fees, and benefits programs offered by different credit score cards. By adequately examining these aspects, individuals can make informed choices when picking a credit rating card that straightens with their monetary goals and circumstances.

Variables Impacting Approval

When using for credit score cards post-bankruptcy, recognizing the variables that influence authorization is crucial for people looking for to reconstruct their monetary standing. Complying with an insolvency, credit score ratings frequently take a hit, making it more difficult to qualify for traditional credit scores cards. Demonstrating responsible financial actions post-bankruptcy, such as paying costs on time and keeping credit scores usage low, can additionally favorably influence credit scores card approval.

Guaranteed Vs. Unsecured Cards

Protected debt cards require a money down payment as collateral, typically equal to the credit limit prolonged by the provider. These cards typically provide higher credit rating limitations and reduced interest prices for people with great credit scores. Ultimately, the choice between protected and unprotected credit cards depends on the individual's financial circumstance and credit report objectives.

Building Credit Scores Sensibly

To properly restore credit score post-bankruptcy, developing a pattern of accountable credit usage is important. Additionally, maintaining credit report card balances reduced loved one to the credit report limit can favorably influence credit ratings.

One more strategy for developing credit history responsibly is to check credit report reports consistently. By evaluating credit score reports for mistakes or indications of identification theft, people can address problems promptly and preserve the precision of their credit report. Furthermore, it is a good idea to avoid from opening several brand-new accounts at once, as this can indicate economic instability to potential lenders. Instead, concentrate on gradually expanding debt accounts and website link showing consistent, liable credit report actions with time. By complying with these techniques, people can gradually reconstruct their credit rating post-bankruptcy and work in the direction of a healthier monetary future.

Enjoying Long-Term Perks

Having actually developed a foundation of responsible credit scores management post-bankruptcy, people can currently focus on leveraging their enhanced credit reliability for long-lasting financial advantages. By constantly making on-time repayments, keeping credit application low, and monitoring their credit records for precision, previous bankrupts can gradually restore their credit report. As their credit history increase, they might become qualified for better credit rating card provides with reduced rates of interest and higher credit scores restrictions.

Reaping long-lasting benefits from boosted credit reliability extends past simply credit report cards. Furthermore, a favorable debt account can enhance task potential customers, as some companies might inspect debt records as part of the working with process.

Final Thought

In conclusion, previous insolvent people may have problem safeguarding charge card complying with discharge, but there are choices readily available to help rebuild credit score. Recognizing the different sorts of credit report cards, variables impacting approval, and the importance of responsible charge card usage these details can assist individuals in this circumstance. By selecting the ideal card and using it properly, former bankrupts can slowly enhance their credit history rating and enjoy the long-lasting benefits of having accessibility to credit scores.

Demonstrating responsible financial behavior post-bankruptcy, such as paying costs on time and maintaining you can try this out debt application reduced, can likewise positively influence credit scores card approval. In addition, maintaining credit score card equilibriums low relative to the credit restriction can favorably impact credit rating ratings. By continually making on-time repayments, keeping credit utilization reduced, and checking their credit report reports for precision, former bankrupts can gradually reconstruct their credit history scores. As their debt scores raise, they might become qualified for far better debt card provides with reduced rate of interest prices and higher credit limitations.

Understanding the various kinds of credit report cards, factors affecting approval, and the relevance of accountable credit report card usage can assist individuals in this scenario. secured credit card singapore.

Report this page